Starting January 27, 2013, merchants in the United States and U.S. Territories will be permitted to impose a surcharge on consumers when they use MasterCard or Visa credit card. Back in November 9, 2012, a U.S. judge preliminary approved to a proposed $7.2 billion settlement between merchants and Visa Inc and MasterCard Inc over credit card fees.

From MasterCard:

Pursuant to a settlement of the U.S. merchant class litigation, MasterCard will modify certain rules and business practices to permit U.S. merchants to apply an extra checkout fee, also known as a surcharge, to customers who pay with MasterCard-branded credit cards. The rule change permitting such surcharging will go into effect on January 27, 2013. These fees are not allowed on Debit MasterCard or MasterCard prepaid cards.

From Visa:

What is a Surcharge?

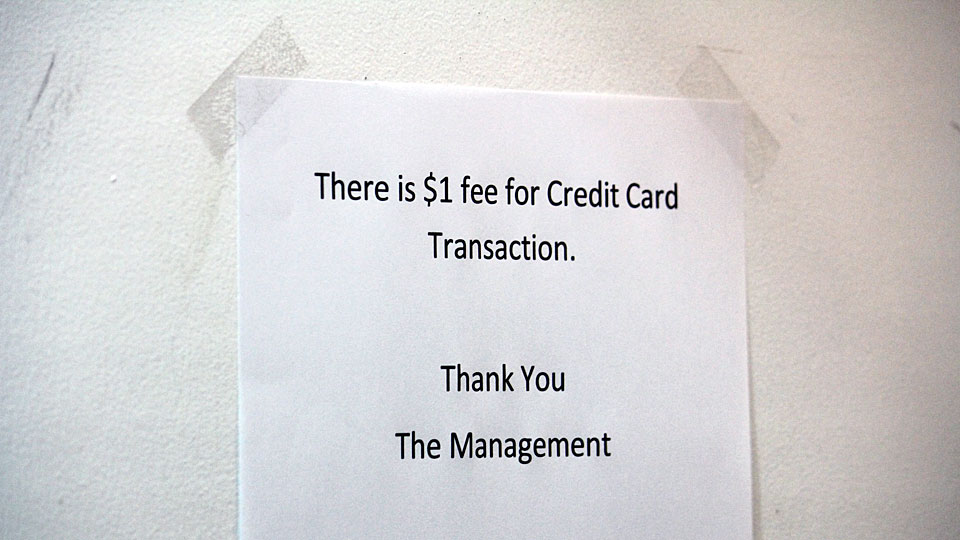

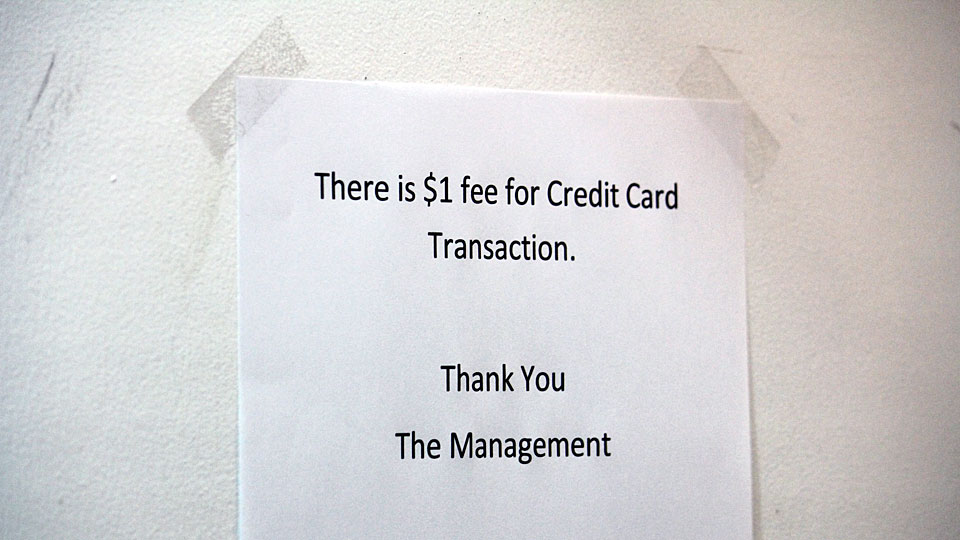

A payment card surcharge is a fee that a retailer adds to the cost of a purchase when a customer uses a payment card.

Changes to Surcharging Fees in the United States

Beginning January 27, 2013, merchants in the United States and U.S. Territories will be permitted to impose a surcharge on consumers when they use a credit card.

Historically Visa has not permitted retailer surcharging, but allowing surcharging was a key provision required by merchants to settle long-standing litigation brought by a class of retailers in 2005.

This settlement takes effect on Sunday January 27, 2013 in the United States with the exception of the following 10 States where there are laws limiting or prohibiting surcharges:

- California

- Colorado

- Connecticut

- Florida

- Kansas

- Maine

- Massachusetts

- New York

- Oklahoma

- Texas

The amount of surcharges is limited up to 4%.

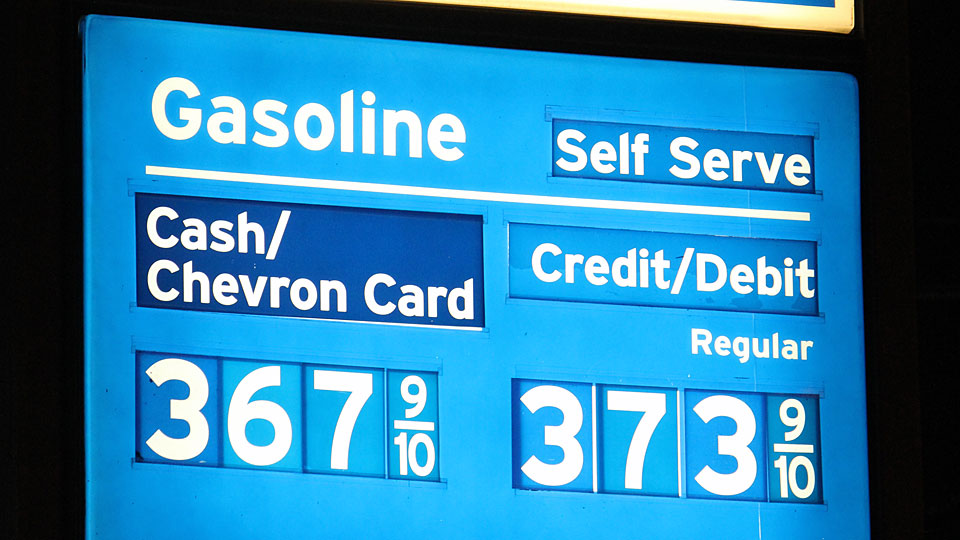

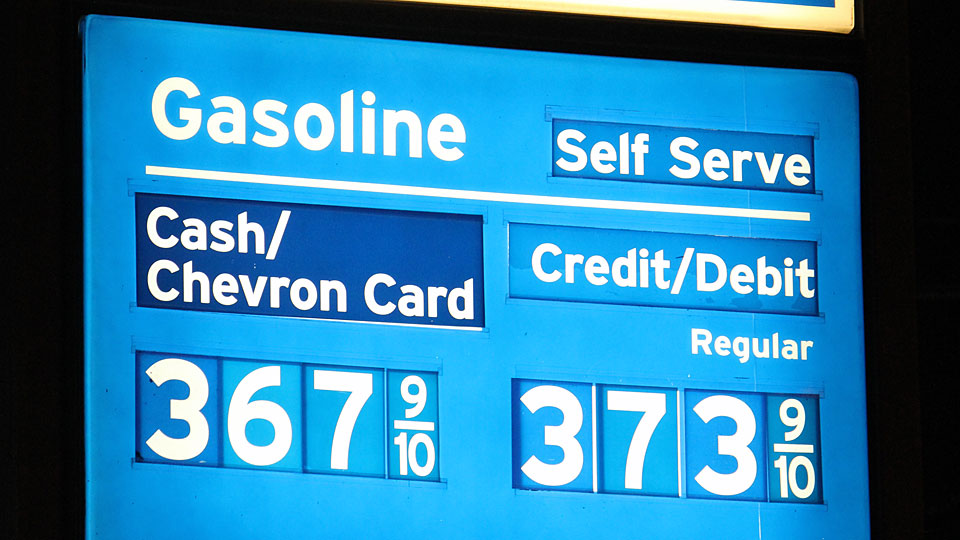

Merchants have been giving “cash discount” as workaround to MasterCard’s and Visa’s Operating Regulations against surcharging.