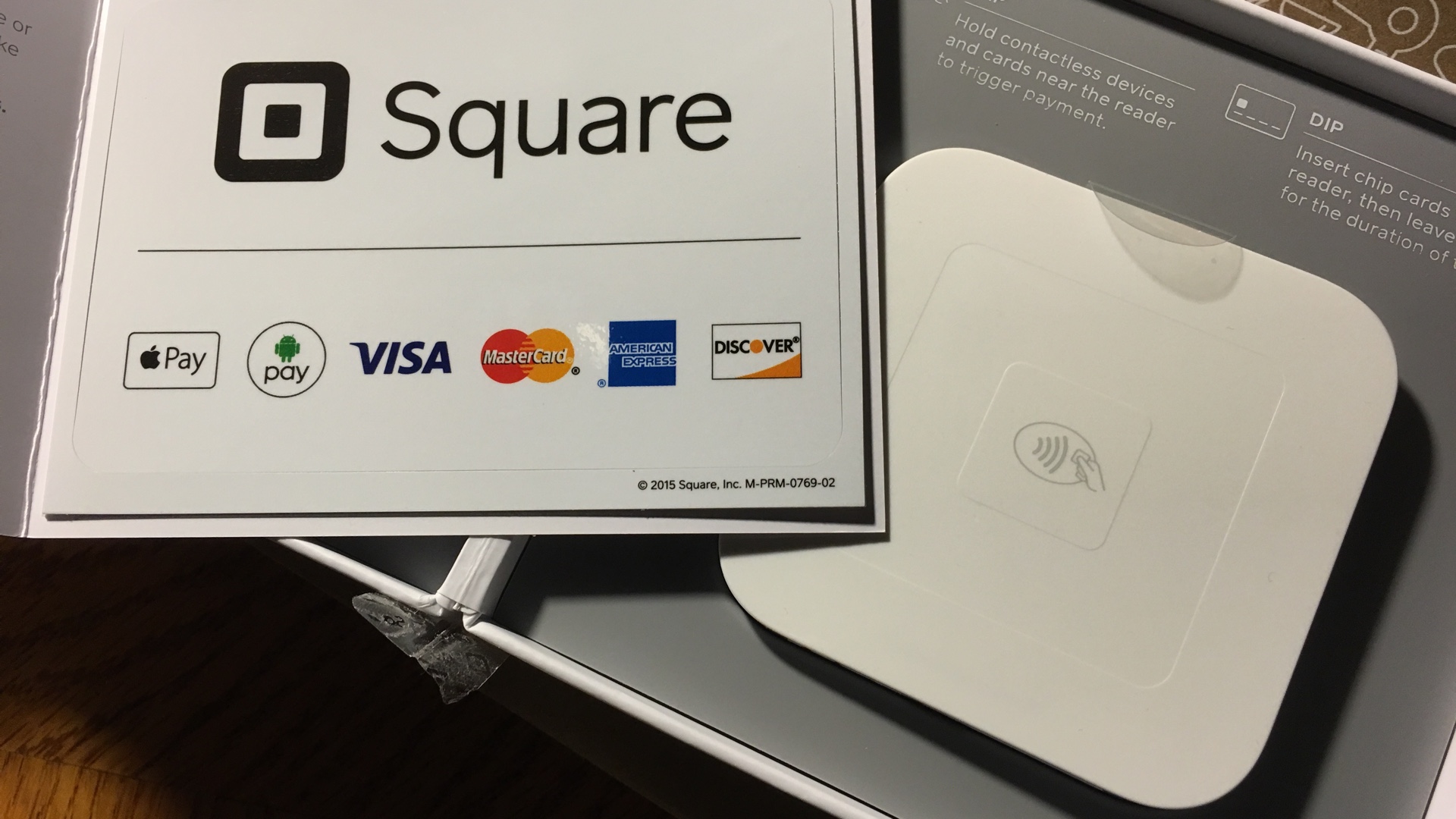

Square Contactless and Chip Reader

Accept Apple Pay and chip cards everywhere.

We received our Square Contactless and Chip Reader a few days ago. We can now start accepting Apple pay and other contactless payments.

Celebrating 20 years of Nonsense, Powered by Natural Intelligence.

Square Contactless and Chip Reader

Accept Apple Pay and chip cards everywhere.

We received our Square Contactless and Chip Reader a few days ago. We can now start accepting Apple pay and other contactless payments.

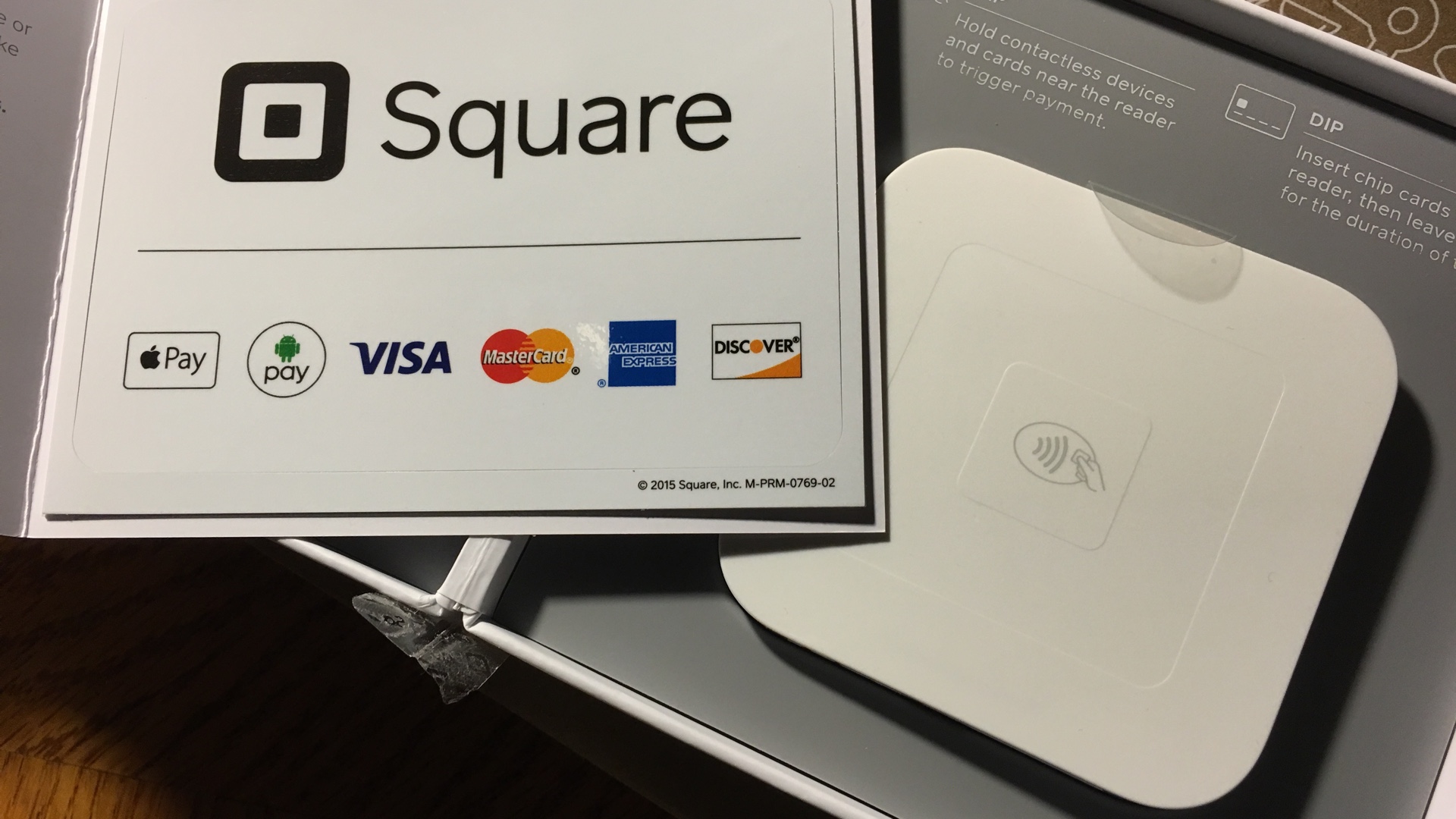

Effective October 30, 2015, we are no longer accepting new customers. Existing customers can continue to use Amazon Register until February 1, 2016, when we will discontinue to service.

Amazon Register (formerly Amazon Local Register) was launched back in August, 2014 with promotional offer of 1.75% on swiped transactions until 12/31/2015. Amazon promised to deliver EMV Card Reader later in 2015. Alas, that day will never come.

Payment processing business has been proven to be challenging even for Square, which reported of $131.5 million loss on $892.2 million in sales in the first nine month of 2015.

——-

Notes:

37prime uses both Square and Amazon Register. The later is the currently preferred payment processor thanks to its promotional offer of 1.75% transaction fee.

Square is shipping its EMV (Chip) Card readers. It costs $29 + Applicable Sales Tax.

In the U.S.A., EMV Card is required starting October 2015; while much of the rest of the world already switched to this system.

I should be getting mine anytime time.

I received the Amazon Local Register Secure Card Reader late Friday, August 15, 2014. The iPhone app for Amazon Local Register still needs a lot of work; it is sluggish and awkward to use. Amazon will definitely fix these issues.

Amazon loves using all cardboard packaging for its own products; environmentally friendly I supposed.

Amazon’s card reader is much larger than its Square counterpart. I find it slightly difficult to install on an iPhone 5s with the case from Apple.

I received the new and thinner Square reader for a few weeks already. I finally took it out of the packaging and compare it with the older reader.

The new Square reader is roughly half the thickness of the old one, but has a slightly larger surface area.

The new Square reader is required by June 1, 2014.

Square might be revising their User Agreement on Surcharge as merchants in the United States and U.S. Territories will be permitted to impose a surcharge on consumers when they use MasterCard or Visa credit card starting January 27, 2013.

Network Rules currently prohibit you from (a) assessing a surcharge for the use of a Card in connection with any transaction, or (b) dispensing cash on any Card transaction.

Notice the word “currently” in the user agreement. Square might have to revise their User Agreement to comply with the new regulation.

California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma and Texas have laws in place limiting or prohibiting merchants from adding surcharge to credit card transaction.

Screen capture of Square User Agreement was taken on Sunday January 27, 2013 04:00 a.m. Pacific Time.

Starting January 27, 2013, merchants in the United States and U.S. Territories will be permitted to impose a surcharge on consumers when they use MasterCard or Visa credit card. Back in November 9, 2012, a U.S. judge preliminary approved to a proposed $7.2 billion settlement between merchants and Visa Inc and MasterCard Inc over credit card fees.

From MasterCard:

Pursuant to a settlement of the U.S. merchant class litigation, MasterCard will modify certain rules and business practices to permit U.S. merchants to apply an extra checkout fee, also known as a surcharge, to customers who pay with MasterCard-branded credit cards. The rule change permitting such surcharging will go into effect on January 27, 2013. These fees are not allowed on Debit MasterCard or MasterCard prepaid cards.

From Visa:

What is a Surcharge?

A payment card surcharge is a fee that a retailer adds to the cost of a purchase when a customer uses a payment card.Changes to Surcharging Fees in the United States

Beginning January 27, 2013, merchants in the United States and U.S. Territories will be permitted to impose a surcharge on consumers when they use a credit card.Historically Visa has not permitted retailer surcharging, but allowing surcharging was a key provision required by merchants to settle long-standing litigation brought by a class of retailers in 2005.

This settlement takes effect on Sunday January 27, 2013 in the United States with the exception of the following 10 States where there are laws limiting or prohibiting surcharges:

The amount of surcharges is limited up to 4%.

Merchants have been giving “cash discount” as workaround to MasterCard’s and Visa’s Operating Regulations against surcharging.